Ontario Moves Dealers To 50% Capacity

The early success of vaccines made us all hope the worst was behind us, but then the OMICRON Covid-19 variant came along, and we are all back in the soup. Worldwide transmission rates are soaring, and Ontario’s infection numbers are as bad now as they were way back in April.

All retailers, including dealers, must move to 50% capacity as of 12:01 a.m. on Sunday, December 19, 2021. In establishing 50% capacity at all retail stores and service facilities, the Ontario Government seeks to slow the spread and help us all enjoy a safe holiday season.

These are things dealers need to know:

- No more than 50% capacity in-store

- Post visible and conspicuous signs that state the capacity limits in the establishment (50 per cent of the maximum occupant load as calculated in accordance with the Fire Code)

- Ensure physical distancing in-store

- Test Drives: If the business permits members of the public to test drive any vehicles:

– members of the public must be actively screened in accordance with the advice, recommendations and instructions of the Office of the Chief Medical Officer of Health before they participate in the test drive https://covid-19.ontario.ca/screening/customer/

and

– all participants in the test drive must wear a mask or face covering in a manner that covers their mouth, nose and chin

- Clean and disinfect commonly touched areas of surfaces and objects, including inside vehicles

Finally, please try to get your booster shot as soon as possible and watch for news from your local office of Public Health.

For more detailed and sector-specific guidance please visit https://www.ontario.ca/page/enhancing-public-health-and-workplace-safety-measures-provincewide-shutdown

See previous Dealer Alerts at www.ucda.org/dealer-alerts/

November 2021

November 2021

The UCDA Is Very Pleased To Announce A New Prime Lender For Your Auto Financing Needs: National Bank Of Canada !

National Bank has been present in the retail financing market for over 20 years. Their continued growth in the automotive segment is a testament to the partnerships they have established with auto dealers across Ontario and the country.

This new agreement between the UCDA and National Bank will allow UCDA Members to benefit from exclusive promotional offers.

If you are not signed up with National Bank as your financing partner and are thinking of doing so, now is the time!

We encourage you to sign up so you can start taking advantage of the National Bank Financing Program. Accreditation criteria apply (see below). As a UCDA Member, you will enjoy:

- exceptional support and strong ground presence from your local National Bank Business Development Manager.

- industry-leading auto-adjudication system allowing you to get around-the-clock credit decisions in minutes, 7 days a week.

- additional support through the Bank’s Operations Centre where Customer Service Agents and Credit Analysts are available to discuss your clients’ financing needs.

- easy paperwork … the simplest loan documents in the industry.

- Quick & Easy Funding allowing you to have access to your funds within hours.

If you already deal with National Bank for your financing needs, you will now gain access to exclusive, promotional offers. To sign up or to find out how this new business relationship between the UCDA and National Bank will benefit your dealership, you can contact UCDA Member Services at 1-800-268-2598 or email: memberservices@ucda.org. You can also contact your local National Bank representative or reach out to National Bank by submitting your request through Dealertrack. A National Bank representative will get back to you within 24 hours. The complete list of the National Bank’s business development team can be found by clicking on the link below.

Program Criteria:

The National Bank program is available for new and used car dealerships. For new car dealerships, the dealership is subject to due diligence that includes, but is not limited to, a satisfactory review of the information provided and referenced on the accreditation application form. Any reliable published information about the dealership is also considered.

For used car dealerships, in addition to the above, the dealership is subject to a satisfactory review of the UCDA Member’s financial situation & operations.

This includes, but is not limited to, a review of the dealership’s most recent financial statements and a review of their client-escalation process. As a guideline, used car dealerships should be in business for a minimum of 5 years and meet a minimum threshold of $1 million in annual sales.

Note:

- National Bank does not offer sub-prime financing.

- National Bank’s program is for retail customers and does

not provide loans to businesses.

On The Horns Of A Dilemma

“May you live in interesting times.”

Commonly considered an ancient Chinese curse of sorts, can anyone question that the saying certainly applies these days?

It’s not news to dealers that the squeeze is on when it comes to used vehicle inventory. It’s a global problem and not one that will be easily solved in the short term, although there is hope inventories will expand in 2022.

As with any supply/demand pressure, it creates hardships, but also opportunities. In response, dealers are having to look to sources for vehicles they did not traditionally consider.

For example, some dealers are finding leasing companies are not as willing as they once were to wholesale off-lease vehicles, preferring, given current market conditions, to keep the vehicles in their own inventory for re-lease or sale at retail prices.

One way dealers have found to get around this, so to speak, is to have the consumer exercise their lease buyout right (if the lease allows one) and then have the customer sell the vehicle to them. The downside, of course, is that the consumer has to pay HST to buyout the lease, and

there is no way to recover this.

Having stated the obvious, this is an example of an opportunity in the face of a dilemma.

While it’s true the HST has to be paid, the consumer is also getting top dollar for the vehicle when they sell it … so the profit may exceed the HST on the table. In addition, the consumer who has exercised the right to purchase the lease, now has an asset they can trade against a new lease or purchase from you and thereby can reduce the HST payable in that way.

No one denies times are hard right now, but if you look around you will find some dealers are still thriving in this market … maybe they know something about how to navigate “interesting times”?

Sign Of The Times

In another story, developing as the result of the present inventory crunch, we are getting calls from some dealers complaining that other dealers will not sell them vehicles.

Of course, no dealer is obliged to sell anyone a vehicle, but lately, it seems some dealers will not sell to other dealers, for any price. However, some of these same dealers are willing to sell to the dealer owner as an individual.

Why this should be is beyond us, but it poses a problem.

Can a private individual buy a vehicle, then sell it to their own dealership, so it can sell the vehicle retail?

Unfortunately, the answer is “No”.

That would make that person a curbsider. It is illegal to buy and flip cars for business without a dealer licence. That is why you need a licence in the first place. Don’t get on the wrong side of OMVIC and the law here.

The UCDA doesn’t recommend that Members refuse to sell to other dealers. However, if you run into this problem when looking for inventory, it’s best to simply move on and try to find a better source.

Nominees

No, we are not running an election here!

In this context, we are talking about dealers using an ordinary citizen to secretly act for the dealer in the purchase of a motor vehicle.

The role of the nominee is secret because, to the dealer they approach to buy the vehicle, they are just what they seem to be … a normal consumer.

In fact, they are just a straw-man (or straw-woman) for the dealer who wants to obtain the vehicle. They will be paid a small fee and flip the vehicle to that dealer.

If the dealer approached the selling dealer directly to buy the vehicle they likely would refuse to sell to them because they do not sell wholesale. They may also be restricted by their franchise owner not to sell wholesale, or for possible export, or for resale, or just because vehicles are hard to come by these days.

A consumer buying vehicles in this manner is really acting as an unregistered dealer or salesperson for the end dealer, and this activity could get a dealership, and the consumer, charged by OMVIC.

We think the practice is wrong and quite likely illegal. And we don’t think it’s victimless either.

While it’s true the selling dealer gets to sell a vehicle, and the consumer gets a small bird-dog or nominee fee, and of course the end dealer gets what they want, this is still not the end of the story.

Aside from concerns about OMVIC, the consumer buying such a vehicle usually agrees right on the contract that they are not buying the unit for resale or export. Again, the selling dealer has to put this on their contract to satisfy the new vehicle manufacturer who holds their franchise.

The fact the consumer has every intention of flipping the vehicle despite agreeing not to do so leaves a very bad taste. The fact that the end dealer lies in the weeds waiting for their vehicle also smacks of dishonesty.

Aside from the unsavory optics of all of this, what happens if the selling dealer discovers the deception and sues the consumer for breach of contract? Is the end dealer going to indemnify the consumer for the cost of defending themselves, or pay any judgement that might arise?

None of this makes our industry look good and the practice should be avoided. If it continues, we would not be surprised to see swift action to stamp it out.

Lost Or Stolen Dealer Plates

Every dealer knows (or can imagine) the sinking feeling when you lose a dealer plate. It’s a real pain in the neck, especially if you lose it while in transit because the bag fell off the back, or someone stole it, and you need someone to come out with another one so you can drive home!

There are other things you need to think about too and since we have had a couple of calls lately on this subject, let’s run through them here:

- Report the plate lost or stolen to your local licence office. They can replace the plate (for a fee of course) but the unused portion of your validation can still be used. The lost plate will be placed in “inactive” status.

- Report the lost plate to your local police.

- Report, preferably in writing, the fact this plate has been lost to the 407 ETR. You can probably guess why this is prudent.

- Call your insurer. They will appreciate knowing you no longer have that plate and you can give them the new plate number should you choose to replace it at the same time.

If you are using a bag or pouch, make sure it is in good condition. These take quite a beating, and fabric and plastic can only take so much wear and tear. Where possible, take the plate with you or lock it in the trunk if you are leaving the vehicle for a short while, to dissuade thieves.

Dealer Quiz

- The MVDA restricts false advertising in any publication relating to vehicle trading and this covers:

(HINT: There may be more than one right answer here. Choose all answers you think are correct.)

a) False statements

b) Misleading statements

c) Incorrect weather predictions

d) Deceptive statements

e) Incorrect skill testing questions - OMVIC have a number of tools to deal with false advertising, among which are:

a) OMVIC can require the dealer to pay money to all consumers who see the ad

b) Force the dealer to sell the vehicle on the terms advertised

c) OMVIC can require the dealer to publish a retraction

d) Close the dealer for 3 weeks

e) Allow OMVIC free advertising space - A dealer or salesperson can’t use false or deceptive information (or documents), or counsel someone else to, even if they did not create the information.

True or False? - OMVIC can deal with false advertising by requiring

(HINT: There may be more than one right answer here. Choose all answers you think are correct.)

a) That the dealer stop

b) That the dealer publish a retraction in the next 10 issues of their local paper

c) The dealer publish a retraction

d) The dealer publish a correction

e) The dealer to stop and publish a retraction - Everyone knows a dealer or salesperson cannot create fake information or documents, but it is not an OMVIC matter if they explain to someone else how to do it.

True or False?

Ignoring Complaints

Resist the urge to ‘kill the messenger’ and remember, these are used vehicles and problems can arise despite your best efforts. What separates dealers from curbsiders or private sellers is how you respond to those problems when they come up.

Most people (not all, but most) don’t like to complain. If matters have gotten to the point where the customer feels obliged to talk to you about it, it likely warrants a looksee. Ask them to bring the vehicle in so you can discuss the issue. Even if it turns out to be nothing, the customer will be reassured that they made the right decision buying from you because you showed you cared and provided after sale support.

On the other hand, an ignored complaint can be like a small cut; minor at first, but if left to fester, it can become more serious. And we all know customers have many routes available to them to complain if they don’t feel they are being treated fairly.

Turn a negative into a positive at every opportunity.

And, don’t ignore OMVIC!

No one likes to get a call from OMVIC about a complaint, concern or problem. It is like getting a call from the police, or CRA or your doctor with concerning test results … again, some may feel the best first reaction is to not respond. Do not do that.

OMVIC has a job to do. They are contacting you for a reason, and while you can usually reply and swiftly nip things in the bud, if you ignore them, the problem starts to get bigger for both you and OMVIC.

A recent discipline decision shows how costly it can be for a dealer to stick their head in the sand and remain unresponsive when dealing with the regulator. Don’t make a mountain out of what should be a molehill. Face the concern head-on and if you need advice, contact the UCDA legal department:

Answers

- The correct answers are a), b) and d). No registrant shall make false, misleading or deceptive statements in any advertisement, circular, pamphlet or material published by any means relating to trading in motor vehicles.

- The answer is c). If the registrar believes on reasonable grounds that a registrant is making a false, misleading or deceptive statement in any advertisement, circular, pamphlet or material published by any means, the registrar may,

(a) order the cessation of the use of such material;

(b) order the registrant to retract the statement or publish a correction of equal prominence to the original publication; or

(c) order both a cessation described in clause (a) and

a retraction or correction described in clause (b). - The answer is True. No registrant shall furnish, assist in furnishing or induce or counsel another person to furnish or assist in furnishing any false or deceptive information or documents relating to a trade in a motor vehicle.

- The correct answers are a), c), d) and e). If the registrar believes on reasonable grounds that a registrant is making a false, misleading or deceptive statement in any advertisement, circular, pamphlet or material published by any means, the registrar may,

(a) order the cessation of the use of such material;

(b) order the registrant to retract the statement or

publish a correction of equal prominence to the

original publication; or

(c) order both a cessation described in clause (a) and

a retraction or correction described in clause (b). - The answer is False. No registrant shall falsify, assist in falsifying or induce or counsel another person to falsify or assist in falsifying any information or document relating to a trade in motor vehicles.

October 2021

Leases and Safety

MVIS Changes

Many of our Members have repair facilities, and many

perform motor vehicle safety inspections. Many Members

who are MVIS stations will have received the notice from MTO

announcing a change to “Passenger Transportation Vehicle”

(PTV) safety requirements.

The communication was perhaps unfortunate as it has

caused some confusion. It refers to vehicles that can carry

10 passengers or less and announces these will need semiannual safety inspections as of July 1, 2021.

Thanksgiving Day 2021

Thanksgiving Day

Dealers are legally required to close on Thanksgiving Monday, October 11th, unless their local municipality has passed a by-law exempting retail businesses from the requirement to close on statutory holidays. If in doubt, check with your local municipality’s by-law department.

Dealers may be open on Saturday, October 9th and, if they wish, on Sunday, October 10th.

The UCDA search facility will be closed on Thanksgiving Monday, but will be open as usual from 9:00 a.m. to 5:00 p.m. on Saturday, October 9th and 9:00 a.m. to 8:00 p.m. on Tuesday, October 12th.

On-line searches will be available over the Thanksgiving weekend at www.ucdasearches.com.

October 2021

Used Vehicle Market Sourcing Issues & Price Jumps

Building on our survey earlier in the year, we once again partnered with our friends at DesRosiers Automotive Consultants to see what impacts the ongoing pandemic and the supply-side microchip issues have had on the used vehicle market.

Nearly 500 Members – including both independent used vehicle dealers, and the used vehicle operations of franchised new vehicle dealers – responded to our survey and offered their take on what the first half of 2021 had brought.

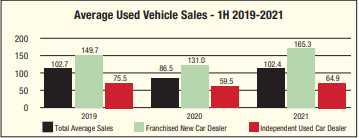

The used vehicle market outperformed the new vehicle market in 2020, but the first 6 months of 2020 were nevertheless difficult for the used vehicle dealer community. Respondents indicated that average sales in their stores fell from 102.7 units in the first half of 2019 to 86.5 units. However, this average sales figure bounced back to nearly the same pre-pandemic levels – 102.4 units on average – in the first half of this year.

New car dealers exceeded their 2019 sales volumes while independent used car dealers noted a smaller recovery – a dynamic directly related to access to vehicles in a market where demand often exceeded supply.

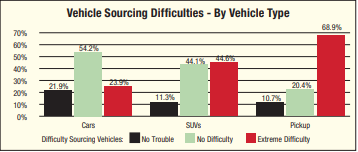

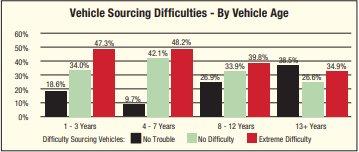

Ongoing supply issues facing both new and used vehicle dealers were a topic of particular concern in the first half of 2021 with dealers noting extreme difficulties sourcing pickups and SUVs. Comparatively, passenger cars were easier for dealers to get their hands on although difficulties were present there as well. In terms of age groups, newer vehicles – both 1-3 and 4-7 years old – were unsurprisingly harder to source than older vehicles.

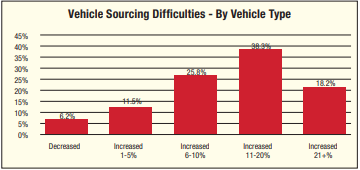

Among the surveyed dealers, only 6.2% noted overall price decreases for their used vehicles. The largest category – at 38.3% – cited average price increases of 11% to 20%. On the more drastic end, 18.2% of respondents cited price increases in excess of 20%.

“The sentiments of used vehicle dealers paint a clear trend for the first half of this year” commented Andrew King, Managing Partner of DesRosiers. “Although sales volumes bounced back, limited supply led to clear increases in the prices of used vehicles as demand spiked and vehicles continued to flow south across the border.”

Information Source: DesRosiers Automotive Consultants Inc., and the UCDA

Fake Appraisals

The Form can be obtained at any Driver and Vehicle Licence Office and can also be found here:

Be aware, however, that the government expects your honest opinion. If you artificially report low valuations or otherwise act improperly, it is feasible the tax authority may take issue with you.

We have heard of dealers being asked to conduct such appraisals based only on photographs. We urge Members to just say “No” to such a request. You need to see the vehicle and provide your best estimate as to value in good faith and in a proper manner.

The Form states that anyone who knowingly makes a false or misleading statement is guilty of an offence under the Ontario Retail Sales Tax Act. For the sake of your reputation, licence and what little money you are making doing this, any less than your best is not worth it.

Equity Games

We all know about negative equity, and how some dealers will try to hide it by tinkering with vehicle trade-in or sale valuations. A little bit here, a little bit there. OMVIC has told dealers to stop that and be up front with the bank, and the consumer, about the hows and whys of negative equity deals. Honesty is the best policy.

In one recent situation, a dealer artificially lowered the sale price of a vehicle on paper to show a larger down payment, (in reality, the customer was putting nothing down) which had the effect of costing the consumer less HST. The customer’s trade-in had enough equity to cover the down payment being shown (used cars are worth a lot these days, as you know). Lower sale price = lower tax. Simple math right?

Now the consumer does not think it was such a great idea after all and even though the dealer did it with the customer’s full knowledge, now the dealer has to worry about:

- An angry customer

- The Canada Revenue Agency

- OMVIC

Games like this are very short-sighted. They get a deal done at that moment, but the long game player knows the true value of a good deal is that it stays together and does not keep anyone awake at night. No deal is worth the alternative.

Play to win and avoid silly games.

Mandating Vaccines In The Workplace

We predicted, before Christmas, in Front Line, that 2021 would be the ‘year of the vaccine’. Looks like we weren’t far off.

Dealers are many things of course, entrepreneurs, taxpayers, community supporters. They are also employers and like many employers, dealers have to navigate uncharted waters right now when it comes to vaccines.

Some members have made the decision to require staff to be vaccinated and naturally wonder what the law might have to say about that.

As many of us know, there has been much talk lately about ‘vaccine passports’ and we also know, since September 22, 2021, in Ontario, proof of vaccine has been required to enter sporting events, concerts, restaurants and similar venues. That should give you a hint as to which way the wind is blowing on the legality of employers requiring employees returning to the office to be fully vaccinated.

It is not just a personal health issue, as we know medical experts have made it clear there is a real and present danger not just to the unvaccinated, but also to others with whom they come into contact, such as other staff, customers and suppliers.

Employees can show exemptions, for medical reasons, but the employer has the right to have their own medical professional assess such claims and, where physical attendance at the office, showroom or repair bays is required, accommodation is not really practical.

These issues are not without controversy. We have even had a couple of messages from dealers who are ‘antivaxxers’, but, on the whole, most dealers are concerned for the health and safety of their workplaces and businesses. They are also, rightly, concerned about their own liability if folks get ill due to their failure to develop a meaningful policy in this regard.

There are plenty of employment law firms working on such policies for all sorts of businesses right now and this will continue through the rest of 2021.

Here’s hoping by 2022 we can look back on this as a bad memory.

Buying Vehicles Privately

COVID-19 has affected virtually every aspect of our economy from the ‘gig’ to the showroom floor. Dealers are seeing dwindling vehicle supplies; with the scarcity of computer chips affecting new vehicle supply, the tight used vehicle market shows signs of further tightening in the months ahead.

Of course, that means prices will increase, but the more immediate problem is the need to source inventory in the first place.

We are seeing more and more of our Members turning to the non-wholesale market to find decent used inventory. Many are buying vehicles from private sellers for the first time.

Common questions can arise:

1. When buying a car from a private (non-dealer) owner, do we have to pay tax to the seller?

The answer is No, unless the seller is an HST Registrant (like you, i.e. a business). Ordinary citizens do not collect tax and would have no one to remit the tax to even if they did!

2. What bill of sale do we use, wholesale or retail?

Use a wholesale bill of sale when buying a vehicle from anyone. Also, make sure you complete a disclosure statement to cover the required 22 disclosures you need to get from a consumer about their car.

Of course, the UCDA can supply forms as needed.

3. Can a dealer, buying a car from a private seller, recover the HST “trapped” in the price paid to the seller?

No, dealers have not been able to do that since 1996 when the NOTIONAL input tax credit was taken away. Why are we mentioning this? Because lately we have been hearing reports that some dealers are trying to claim the notional tax perhaps not realizing they cannot successfully make such claims.

Ministry Postpones MVDA Reforms

Following online input from the UCDA, other industry and consumer groups and many individual dealers about proposals to amend the regulations to the Motor Vehicle Dealers Act, 2002, the Ministry of Government and Consumer Services has decided to postpone implementing its proposed reforms, for now.

There was enough concern and outright opposition to some of the so-called “red tape reduction” proposals that the Ministry has wisely decided to have a full consultation with all stakeholders sometime in 2022.

The UCDA agrees with this decision, as the longterm effects of some of the proposals did not appear to be well thought through. The UCDA’s biggest concern related to a vague proposal that would have seen changes to allow dealers to do business anywhere they wanted to, with no regard for the need for a proper dealer premises. Taken to an extreme, dealers would have been able to operate like curbsiders, save only for the need to carry an OMVIC registration card. Already some dealer premises are little more than large closets with a desk and a chair that rarely, if ever, get used.

The UCDA eagerly looks forward to the more extensive consultations next year. We don’t want to stand in the way of the trend towards a more digital selling process. But this move needs to be made in a way that continues to emphasize an increasingly professional and consumerfriendly industry.

UCDA and Childhood Cancer – Family Stories

In our last issue of Front Line, we wrote about the UCDA’s ongoing donations to charitable organizations supporting the families of children battling cancer. Following is the first in a series of stories told by the families of these children.

Candlelighters (Ottawa) … Two Families’ Stories

“Our middle daughter was diagnosed with Acute Lymphoblastic Leukemia. This diagnosis came one week after her baby brother was born. Candlelighters was quick to help us in our situation. They are unique where we truly see a direct connection and immediate effect from a donor’s donation to the family’s day-to-day need.

Without Candlelighters, our family would not have felt some of the stress lifted so soon after diagnosis and the intense treatment schedule. Thank you Candlelighters”.

From the mother of G

It’s a day we will never forget! The moment we heard the words “I believe your son has leukemia” have been etched in my husband’s and my brain forever! Then the questions flash though your mind, how can that be? How do we tell my child he has cancer? Will he survive? How do we live without him?

The fear and unknown can be almost crippling! S. was admitted to hospital and we really didn’t know what was going to happen. We didn’t get a chance to go home and pick up toiletries, we had nothing but the clothes on our back. It was very late when we were brought up to his room.

Since we had nothing, our nurse brought us a little care package. In it was toothpaste, toothbrush, deodorant, a chapstick, shampoo …. All the little necessities you need. The sticker on the bag said it was from the Candlelighters. They were there from the first night to lend a helping hand.

The next morning our interlink nurse asked if we knew who the Candlelighters were? We said “No”. We had never heard of them until the night before they gave us the bag with their name on it.

She then explained who they were and proceeded to pull out things. She gave us a couple of books about S’s cancer and a cancer nutrition cook book to read wanting to help us get through treatment; a binder to sort out the names of doctors, nurses and staff members who we would have to recall.

The binder also told me about the Candlelighters and the things they do to help cancer families. We received gas cards, red apron coupons for food while S was in the hospital, parking passes to save us the expense of parking.

S also collected Courage Beads – beads explaining that every bead meant something whether it’s chemotherapy, getting a lumbar puncture, needle poke, a night spent in the hospital. These beads tell your story in a most beautiful way. It is also extremely visual for people who just don’t understand what these kids go through. And it was all from the Candlelighters!

A week after S. was diagnosed the Candlelighters called us and asked if S. would like an iPad to help keep up with friends and help him with any homework he may have during treatment. S. was out of school for a year and a half, one of his teachers would FaceTime him nightly to do school work no matter what his blood counts were he couldn’t get sick over FaceTime and he was able to stay up to date on his school work.

The iPad was not only an entertaining toy but it helped him stay connected with the outside world. 2 weeks into treatment Candlelighters asked if we would like tickets to a concert or a hockey game in Suite Seats, a night to forget about cancer and have fun as a family. We have enjoyed a couple of shows and hockey games thanks to the Candlelighters, family outings we could never have afforded. We have great memories from those times.

S. was starting a new medication about a year into treatment. At the beginning, it wasn’t covered by insurance. The cost was $115.00 per dose, and Candlelighters paid it. I cannot tell you how much that helped. Candlelighters helped our family over and over again. They provide things that seem small, but make a big difference. They are always there, always willing to help wherever they can. It is so important and so valuable.

Thank you from S.’s parents and family

Curbsider Pays Big-Time

On May 25th he pleaded guilty and accepted a fine of $60,000 plus probation.

Labour Day 2021

Labour Day

Dealers are required to be closed on Labour Day, Monday, September 6th, unless their local municipality has passed a by-law exempting retail businesses from the requirement to close on statutory holidays. If in doubt, check with your local municipality’s by-law department.

Dealers may be open on Saturday, September 4th and, should they wish to, on Sunday, September 5th .

The UCDA search facility will be closed on Labour Day, but will be available as usual from 9:00 a.m. to 5:00 p.m. on Saturday, September 4th and from 9:00 a.m. to 8:00 p.m. on Tuesday, September 7th.

On-line searches will be available throughout the Labour Day weekend at www.ucdasearches.com.