Used Vehicle Market Sourcing Issues & Price Jumps

Building on our survey earlier in the year, we once again partnered with our friends at DesRosiers Automotive Consultants to see what impacts the ongoing pandemic and the supply-side microchip issues have had on the used vehicle market.

Nearly 500 Members – including both independent used vehicle dealers, and the used vehicle operations of franchised new vehicle dealers – responded to our survey and offered their take on what the first half of 2021 had brought.

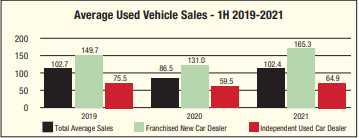

The used vehicle market outperformed the new vehicle market in 2020, but the first 6 months of 2020 were nevertheless difficult for the used vehicle dealer community. Respondents indicated that average sales in their stores fell from 102.7 units in the first half of 2019 to 86.5 units. However, this average sales figure bounced back to nearly the same pre-pandemic levels – 102.4 units on average – in the first half of this year.

New car dealers exceeded their 2019 sales volumes while independent used car dealers noted a smaller recovery – a dynamic directly related to access to vehicles in a market where demand often exceeded supply.

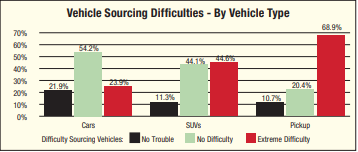

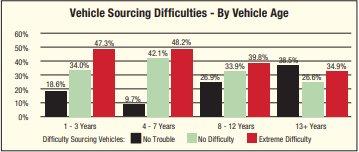

Ongoing supply issues facing both new and used vehicle dealers were a topic of particular concern in the first half of 2021 with dealers noting extreme difficulties sourcing pickups and SUVs. Comparatively, passenger cars were easier for dealers to get their hands on although difficulties were present there as well. In terms of age groups, newer vehicles – both 1-3 and 4-7 years old – were unsurprisingly harder to source than older vehicles.

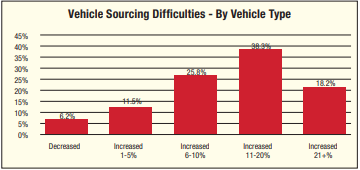

Among the surveyed dealers, only 6.2% noted overall price decreases for their used vehicles. The largest category – at 38.3% – cited average price increases of 11% to 20%. On the more drastic end, 18.2% of respondents cited price increases in excess of 20%.

“The sentiments of used vehicle dealers paint a clear trend for the first half of this year” commented Andrew King, Managing Partner of DesRosiers. “Although sales volumes bounced back, limited supply led to clear increases in the prices of used vehicles as demand spiked and vehicles continued to flow south across the border.”

Information Source: DesRosiers Automotive Consultants Inc., and the UCDA

Fake Appraisals

The Form can be obtained at any Driver and Vehicle Licence Office and can also be found here:

Be aware, however, that the government expects your honest opinion. If you artificially report low valuations or otherwise act improperly, it is feasible the tax authority may take issue with you.

We have heard of dealers being asked to conduct such appraisals based only on photographs. We urge Members to just say “No” to such a request. You need to see the vehicle and provide your best estimate as to value in good faith and in a proper manner.

The Form states that anyone who knowingly makes a false or misleading statement is guilty of an offence under the Ontario Retail Sales Tax Act. For the sake of your reputation, licence and what little money you are making doing this, any less than your best is not worth it.

Equity Games

We all know about negative equity, and how some dealers will try to hide it by tinkering with vehicle trade-in or sale valuations. A little bit here, a little bit there. OMVIC has told dealers to stop that and be up front with the bank, and the consumer, about the hows and whys of negative equity deals. Honesty is the best policy.

In one recent situation, a dealer artificially lowered the sale price of a vehicle on paper to show a larger down payment, (in reality, the customer was putting nothing down) which had the effect of costing the consumer less HST. The customer’s trade-in had enough equity to cover the down payment being shown (used cars are worth a lot these days, as you know). Lower sale price = lower tax. Simple math right?

Now the consumer does not think it was such a great idea after all and even though the dealer did it with the customer’s full knowledge, now the dealer has to worry about:

- An angry customer

- The Canada Revenue Agency

- OMVIC

Games like this are very short-sighted. They get a deal done at that moment, but the long game player knows the true value of a good deal is that it stays together and does not keep anyone awake at night. No deal is worth the alternative.

Play to win and avoid silly games.

Mandating Vaccines In The Workplace

We predicted, before Christmas, in Front Line, that 2021 would be the ‘year of the vaccine’. Looks like we weren’t far off.

Dealers are many things of course, entrepreneurs, taxpayers, community supporters. They are also employers and like many employers, dealers have to navigate uncharted waters right now when it comes to vaccines.

Some members have made the decision to require staff to be vaccinated and naturally wonder what the law might have to say about that.

As many of us know, there has been much talk lately about ‘vaccine passports’ and we also know, since September 22, 2021, in Ontario, proof of vaccine has been required to enter sporting events, concerts, restaurants and similar venues. That should give you a hint as to which way the wind is blowing on the legality of employers requiring employees returning to the office to be fully vaccinated.

It is not just a personal health issue, as we know medical experts have made it clear there is a real and present danger not just to the unvaccinated, but also to others with whom they come into contact, such as other staff, customers and suppliers.

Employees can show exemptions, for medical reasons, but the employer has the right to have their own medical professional assess such claims and, where physical attendance at the office, showroom or repair bays is required, accommodation is not really practical.

These issues are not without controversy. We have even had a couple of messages from dealers who are ‘antivaxxers’, but, on the whole, most dealers are concerned for the health and safety of their workplaces and businesses. They are also, rightly, concerned about their own liability if folks get ill due to their failure to develop a meaningful policy in this regard.

There are plenty of employment law firms working on such policies for all sorts of businesses right now and this will continue through the rest of 2021.

Here’s hoping by 2022 we can look back on this as a bad memory.

Buying Vehicles Privately

COVID-19 has affected virtually every aspect of our economy from the ‘gig’ to the showroom floor. Dealers are seeing dwindling vehicle supplies; with the scarcity of computer chips affecting new vehicle supply, the tight used vehicle market shows signs of further tightening in the months ahead.

Of course, that means prices will increase, but the more immediate problem is the need to source inventory in the first place.

We are seeing more and more of our Members turning to the non-wholesale market to find decent used inventory. Many are buying vehicles from private sellers for the first time.

Common questions can arise:

1. When buying a car from a private (non-dealer) owner, do we have to pay tax to the seller?

The answer is No, unless the seller is an HST Registrant (like you, i.e. a business). Ordinary citizens do not collect tax and would have no one to remit the tax to even if they did!

2. What bill of sale do we use, wholesale or retail?

Use a wholesale bill of sale when buying a vehicle from anyone. Also, make sure you complete a disclosure statement to cover the required 22 disclosures you need to get from a consumer about their car.

Of course, the UCDA can supply forms as needed.

3. Can a dealer, buying a car from a private seller, recover the HST “trapped” in the price paid to the seller?

No, dealers have not been able to do that since 1996 when the NOTIONAL input tax credit was taken away. Why are we mentioning this? Because lately we have been hearing reports that some dealers are trying to claim the notional tax perhaps not realizing they cannot successfully make such claims.

Ministry Postpones MVDA Reforms

Following online input from the UCDA, other industry and consumer groups and many individual dealers about proposals to amend the regulations to the Motor Vehicle Dealers Act, 2002, the Ministry of Government and Consumer Services has decided to postpone implementing its proposed reforms, for now.

There was enough concern and outright opposition to some of the so-called “red tape reduction” proposals that the Ministry has wisely decided to have a full consultation with all stakeholders sometime in 2022.

The UCDA agrees with this decision, as the longterm effects of some of the proposals did not appear to be well thought through. The UCDA’s biggest concern related to a vague proposal that would have seen changes to allow dealers to do business anywhere they wanted to, with no regard for the need for a proper dealer premises. Taken to an extreme, dealers would have been able to operate like curbsiders, save only for the need to carry an OMVIC registration card. Already some dealer premises are little more than large closets with a desk and a chair that rarely, if ever, get used.

The UCDA eagerly looks forward to the more extensive consultations next year. We don’t want to stand in the way of the trend towards a more digital selling process. But this move needs to be made in a way that continues to emphasize an increasingly professional and consumerfriendly industry.

UCDA and Childhood Cancer – Family Stories

In our last issue of Front Line, we wrote about the UCDA’s ongoing donations to charitable organizations supporting the families of children battling cancer. Following is the first in a series of stories told by the families of these children.

Candlelighters (Ottawa) … Two Families’ Stories

“Our middle daughter was diagnosed with Acute Lymphoblastic Leukemia. This diagnosis came one week after her baby brother was born. Candlelighters was quick to help us in our situation. They are unique where we truly see a direct connection and immediate effect from a donor’s donation to the family’s day-to-day need.

Without Candlelighters, our family would not have felt some of the stress lifted so soon after diagnosis and the intense treatment schedule. Thank you Candlelighters”.

From the mother of G

It’s a day we will never forget! The moment we heard the words “I believe your son has leukemia” have been etched in my husband’s and my brain forever! Then the questions flash though your mind, how can that be? How do we tell my child he has cancer? Will he survive? How do we live without him?

The fear and unknown can be almost crippling! S. was admitted to hospital and we really didn’t know what was going to happen. We didn’t get a chance to go home and pick up toiletries, we had nothing but the clothes on our back. It was very late when we were brought up to his room.

Since we had nothing, our nurse brought us a little care package. In it was toothpaste, toothbrush, deodorant, a chapstick, shampoo …. All the little necessities you need. The sticker on the bag said it was from the Candlelighters. They were there from the first night to lend a helping hand.

The next morning our interlink nurse asked if we knew who the Candlelighters were? We said “No”. We had never heard of them until the night before they gave us the bag with their name on it.

She then explained who they were and proceeded to pull out things. She gave us a couple of books about S’s cancer and a cancer nutrition cook book to read wanting to help us get through treatment; a binder to sort out the names of doctors, nurses and staff members who we would have to recall.

The binder also told me about the Candlelighters and the things they do to help cancer families. We received gas cards, red apron coupons for food while S was in the hospital, parking passes to save us the expense of parking.

S also collected Courage Beads – beads explaining that every bead meant something whether it’s chemotherapy, getting a lumbar puncture, needle poke, a night spent in the hospital. These beads tell your story in a most beautiful way. It is also extremely visual for people who just don’t understand what these kids go through. And it was all from the Candlelighters!

A week after S. was diagnosed the Candlelighters called us and asked if S. would like an iPad to help keep up with friends and help him with any homework he may have during treatment. S. was out of school for a year and a half, one of his teachers would FaceTime him nightly to do school work no matter what his blood counts were he couldn’t get sick over FaceTime and he was able to stay up to date on his school work.

The iPad was not only an entertaining toy but it helped him stay connected with the outside world. 2 weeks into treatment Candlelighters asked if we would like tickets to a concert or a hockey game in Suite Seats, a night to forget about cancer and have fun as a family. We have enjoyed a couple of shows and hockey games thanks to the Candlelighters, family outings we could never have afforded. We have great memories from those times.

S. was starting a new medication about a year into treatment. At the beginning, it wasn’t covered by insurance. The cost was $115.00 per dose, and Candlelighters paid it. I cannot tell you how much that helped. Candlelighters helped our family over and over again. They provide things that seem small, but make a big difference. They are always there, always willing to help wherever they can. It is so important and so valuable.

Thank you from S.’s parents and family

Curbsider Pays Big-Time

On May 25th he pleaded guilty and accepted a fine of $60,000 plus probation.