Used Vehicle Market Survey ... Outlook For 2022

Continuing our partnership with DesRosiers Automotive Consultants (DAC), the UCDA once again reached out to Members to take the pulse of the industry in Ontario.

Close to 450 UCDA Members responded to our survey with both independent dealers and the used vehicle arms of new vehicle dealers offering their perspective on the state of the market moving into 2022.

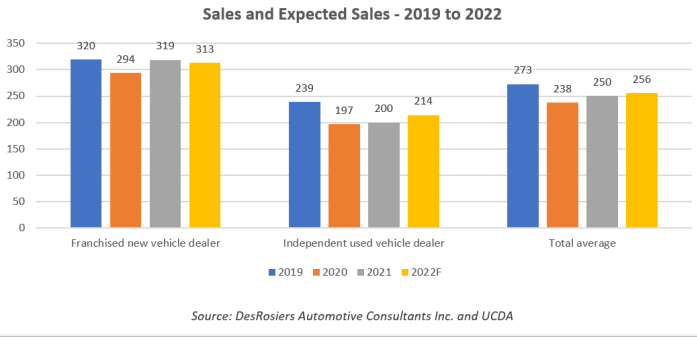

While demand for used vehicles soared in 2021 as a result of the semiconductor driven shortage of new vehicles, supply constraints did not allow the market to grow to its potential. New vehicle dealers saw a moderate growth in sales per store from 294 in 2020 to 319 units for 2021.

Independent used vehicle dealers had a harder time sourcing used vehicles and saw little growth in 2021, with sales per store rising to only 200 units from 197 in 2020. Interestingly, for 2022, opinions were split with independent used vehicle dealers expecting an increase and franchised new vehicle dealers expecting a moderate drop.

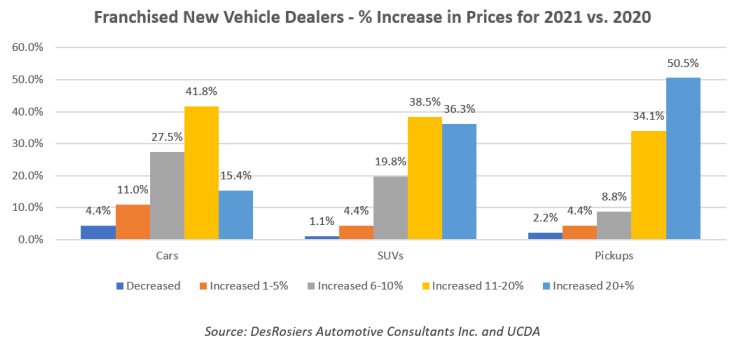

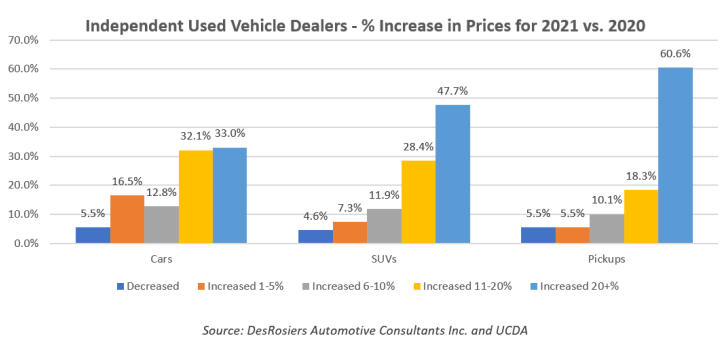

The market situation with booming demand but limited supply obviously led to dramatic price increases. Passenger cars—which have been falling in popularity for years—saw a comparatively mild increase in used prices – although still remarkable in any normal year.

Dealer sentiment showed that passenger car prices saw increases most often in the 11-20% range among new vehicle dealers, and 20+% for independents. For SUVs the pace of inflation was notably greater with close to 47.7% of independents citing increases of over twenty percent for SUVs. Pickups—which were hit hard by the semiconductor shortage and saw significant new vehicle supply issues—saw the most dramatic price increases.

Over half of franchised new vehicle dealers and over sixty percent of independents cited pickup price increases in the twenty plus percent range. “The difficulties in the new vehicle market clearly spilled into the used vehicle market in a dramatic way” commented Andrew King, Managing Partner at DAC “Used vehicle dealers saw prices skyrocket by way of burgeoning demand and limited supply.”

Sad Curbsider

Media reports of a young Ontario man who lost big trying to flip a vehicle for quick profit, missed the point that this activity could be considered curbsiding. If you buy and sell just to make a profit, this is a business activity that requires OMVIC registration.

Reading the stories, it does not sound like this fellow ever intended to insure, plate and drive this vehicle. While it’s sad to see what happened to him, there is a real risk to venturing online with valuable luxury vehicles for sale. Ask any registered motor vehicle dealer!

The 21-year-old (identified as Marco) advertised his uninsured 2017 Mercedes Benz GLE63s for sale on AutoTrader.ca.

Two males, pretending to be potential buyers, contacted him to meet them at a parking lot, where they relieved him of his vehicle in under 10 minutes.

“He was in the car revving the engine, with one foot out the door and I was by the door just holding it open,” Marco told CTV News Toronto. “Then my phone rang and when it did I backed away from the car. He slammed the door, locks it, and tries to drive off.

I’m out of $65,000, which was everything that I had for my young age of 21 and some money I borrowed from my mother as well.”

York Regional Police have received the report, but these stories rarely end well.

Curbsider – Part 2

In another curbsider story, we are reminded that these stories really are the best advertisement to promote purchasing from a dealer!

If consumers don’t already know what a minefield buying privately can be, along comes this story to illustrate it. Dangerous people lurk in the online vehicle-buying world, and looking to make a quick buck includes selling vehicles without declaring past accident history, liens, use, out of province and … odometer inaccuracy.

In this case, the odometer had been “rolled-back” or replaced at some point.

Of course the buyer was told this 2013 Chevy Silverado had 187,000 kms so handing over $11,000 made sense to him. It was only later that he looked at the UVIP and a Carfax that the history showed 455,000 kms in the truck’s past odometer readings.

As usual, the buyer probably does not even know who he handed his money to. The vehicle was not in his name, and if he got a last name or address, that would be surprising. Certainly, a deal started on Facebook and finished in a parking lot sounds just as sketchy as you might imagine.

Loaner Cars And Risk

Courts weigh in from time to time on the issue of loaner cars.

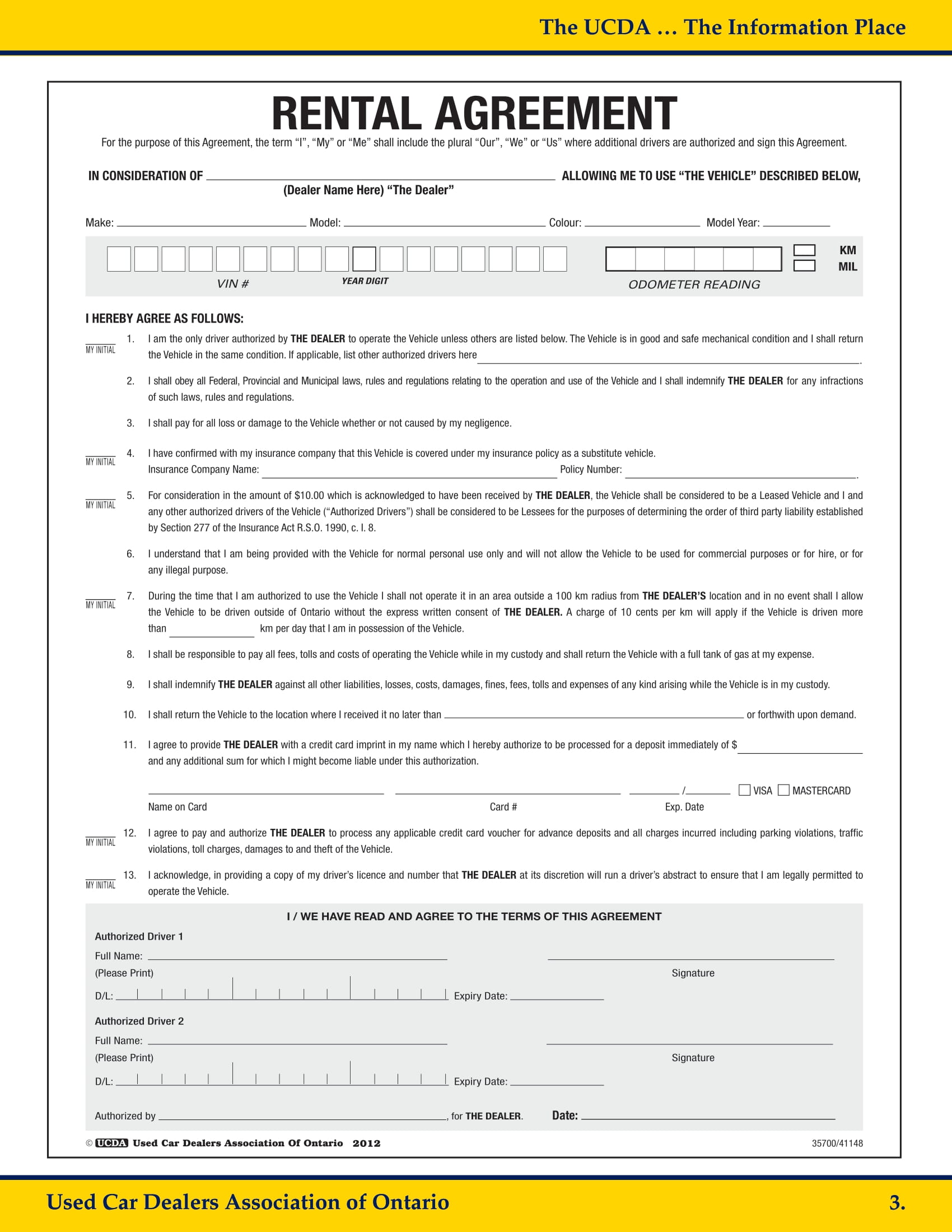

The UCDA has designed a Rental Agreement to try to help navigate the waters for dealers who wish to provide loaner cars to customers whose vehicles are not ready for delivery, or who may be having service work. The agreement can help avoid losses caused by accident or other liabilities while the customer is driving these vehicles. The Agreement, like the law, continues to evolve.

The UCDA Rental Agreement is on page 3 so you can see what it says.

However, a recent court case has thrown some cold water on a dealer’s ability to recover from the customer (or their insurer) in cases where the accident was not the driver’s “fault”.

In Owasco Canadian Car & Camper Rental Ltd. v. Fitzgerald et al., the court focused on Section 263(5)(a.1) of the Ontario Insurance Act which reads:

“(An insured’s) right of action under an agreement … in respect of damages to the insured’s automobile” is limited “to the extent that the person is at fault or negligent in respect of those damages”.

The court goes on to say:

I am satisfied that if s. 263(5)(a.1) does properly apply in this case, it has the effect of entirely extinguishing Owasco’s ability to sue Mr. Fitzgerald under the rental agreement for the damage to the rental car that is at issue in this case. This conclusion necessarily follows from the subsection’s plain wording and from the agreed facts in this case:

… Owasco has “no right of action” against Mr. Fitzgerald under the contract “except to the extent that [he] is at fault or negligent” in respect of the damages to the rental car;

v) Since it is a stipulated fact that Mr. Fitzgerald is entirely blameless for the accident that caused damage to the rental car, Owasco is left with no right of action against him under the rental agreement in respect of this damage.

The court finds the section clearly applies in this case, and the dealer lost the appeal. They will have to absorb the losses caused by the accident to their vehicle.

The whole case can be found here:

Extended Warranty Update

Every couple of years or so, we reach out to extended warranty companies on our list to confirm their products are still underwritten by Ontario Insurance Companies.

In Ontario, dealers can only sell warranties to consumers that are insured or registered with a secured line of credit posted with OMVIC.

The UCDA considers insured products to be the gold standard for consumer and dealer protection, and therefore we recommend our members only sell those products.

For many years, we have invited companies that wish to participate in our list, maintained for our Members, to demonstrate their insurance is proper and in good standing. Those that choose to do so, appear on our list, which we publish in Front Line and online at our extended warranty update https://tinyurl.com/bdf9k949.

Each of the companies listed below have provided the UCDA with a copy of their insurance agreement, along with a written undertaking from the insurer to notify the UCDA in the event the coverage is cancelled or changes are made. The UCDA asks the recognized warranty companies to have insurers provide updates to us, confirming that insurance remains in place.

Verified Insured Warranty Companies

After receiving updates from insurers, here is the current alphabetical list of warranty companies that have met our requirements for insurance recognition:

• Assurant Vehicle Protection Services 1-800-387-0119

• Canada General Warranty Inc. 1-866-320-8975

• Central Administrative Services Company, INC 1-800-222-3020

• Cornerstone United Warranty (XtraRide and AutoXtra) 1-800-774-9992

• Coverage One Warranty 1-866-988-1642

• First Canadian Protection Plans 1-800-381-2580

• Global Warranty 1-800-265-1519

• Guarantee VC/GVC Premium Warranty Co. 1-800-268-3284

• Lubrico Warranty 1-800-668-3331

• Nationwide Auto Warranty 1-888-674-8549

• People’s Choice Warranty Ltd. 1-888-284-2356

• Sym-Tech i-Select Plus 1-800-363-5796 (press 2)

• Veritas Global Protection Services, INC 1-800-222-3020

The UCDA does not endorse any specific warranty company or product, but strongly recommends that Members only offer warranties that are insured by a licensed Ontario insurer.

Salvage Auctions And Liens

Lien searches are useful. Whenever you buy a vehicle, and we do mean whenever, run one. At an average cost of less than $12, it’s the best insurance money can buy. Many dealers are shocked to learn that some auctions don’t do lien searches so, if you don’t do a search, no one else does.

Some of our Members are regular buyers at “salvage” auctions. Some of the bigger players in this area are Copart and Impact Auto Auctions.

For years we have noted that when an insurance company “writes off” a total loss vehicle and sells it at one of these sales, there are often undischarged liens. Many will get discharged once the insured pays the loan with the insurance proceeds. But there have been instances where, for a number of reasons, the loan does not get paid off, or does not get paid off in full, or no one even realizes there is a lien on the unit.

For dealers, this can be a nightmare. These vehicles are usually purchased in pretty rough, non-drivable condition, and it takes a great deal of time and money to make them roadworthy for resale.

Dealers have experienced instances where they invest the time, labour and money in repairs only to find there is a lien registered and they cannot sell the vehicle. Even worse are cases where the dealer does sell it and their customer finds the lien and expects a refund because they cannot sell it, or they have the vehicle repossessed by the lien holder. We have seen, and dealt with, all these scenarios many times.

Of course, everyone blames the dealer for not doing a lien search, although no one has an answer as to what happens if the dealer finds one! We can tell you the solution is time consuming and difficult with minimal co-operation from auctions, insurers and banks.

The dealer, meanwhile, is left to deal with a very angry consumer and no one to help. Naturally, if the dealer is a Member, they turn to the UCDA for help.

Impact Auto Auctions, for example, advise us that their policy on liens is that the buyer is responsible to run a lien search to “confirm that no Lien exists prior to repairing, rebuilding and/ or reselling a Vehicle”.

Copart’s policy is that they expect buyers to report any liens found within 90 days after delivery. They will then assist by enlisting the seller to secure lien discharge as soon as possible. If the lien cannot be removed in a timely manner, the sale would be reversed and the buyer refunded the purchase price, but not the cost of any repairs performed.

We want to see our Members protected. Given the aggravation that liens can pose months and even years after these sales, it’s hard to imagine a better investment than a lien search as part of your buying process.