NEW MVDA KEY ELEMENTS COURSE LAUNCHED!

The UCDA and OMVIC are delighted to announce the long-awaited launch of the new Motor Vehicle Dealers Act Key Elements Course. This program was designed to benefit dealers, managers and salespeople who have not yet taken an OMVIC Certification Course (those registered before 1999). It is also for those who have taken the Certification Course prior to the new MVDA being introduced in 2010.

This is a significant expansion of the current education program. With classes held in major cities across Ontario, most UCDA members will not have to drive more than one to two hours to get to a course.

The Key Elements Course will help dealers and salespeople comply with current regulations and legislation governing the wholesale and retail automotive industry. This includes the Motor Vehicle Dealers Act, the Consumer Protection Act and the Sale of Goods Act.

Individuals who successfully pass the MVDA Key Elements Course and maintain registration with OMVIC are entitled to use the OMVIC designation “C.A.L.E. — Certified in Automotive Law and Ethics.”

Class Options…

We’re giving students the option of taking just the 1-Day, Key Elements portion or, taking the class as part of the UCDA’s three-day, comprehensive Dealership Manager Professional Certification Program*:

Option 1:

As part of the UCDA’s management course, students can take the 1-day, Key Elements portion; a multiple choice test is taken in-class at the end of the course day.

Option 2:

Students may take the 3-Day Dealership Manager Professional Certification Program, with the Key Elements Course incorporated on day two. Testing will take place in class, immediately following the Key Elements session.

For those apprehensive about writing a test … don’t worry … the results do NOT in any way affect your OMVIC license! The test is for your benefit, to help ensure you are better informed.

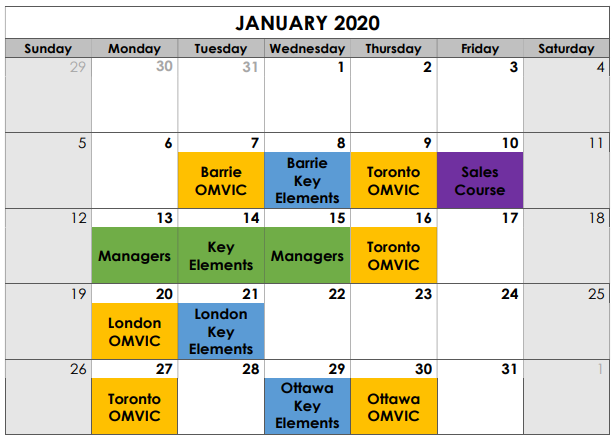

Courses begin in January, 2020. Reserve your spot today!

*Dealership Manager Professional Certification Program

The Dealership Manager Program provides best business practices, processes, strategies and tools to succeed in the areas of leadership and managing people, managing the daily operations of a dealership, marketing and managing the Used Vehicle Department. The program is designed to provide dealers and managers with professional, integrity based management training that also protects both consumers and dealerships through legal compliance.

Insurance Pink Slip May Now Be Displayed On Cell Phone

The Ontario Government has announced, effective September 5, that drivers may now display proof of insurance on their cell phone instead of by way of a paper pink slip, if they wish.

There are a number of conditions to this, of course. Chief among them is not all insurance companies may offer this feature. It’s not clear how this may affect travel outside of Ontario. There is also concern that at some future point, insurers may stop offering paper slips entirely, or charge the insured extra fees for issuing paper slips.

Dealers might wish to check with their insurer as to whether this has any effect on them. The UCDA’s garage insurance program through Baird MacGregor, will continue to issue pink slips to insured members and will not be charging extra fees to do so.

Possible Changes Coming To The Consumer Protection Act (CPA)

Several pieces of legislation have a direct and immediate effect on the day-to-day business of motor vehicle dealers.

One is obviously the Motor Vehicle Dealers Act, others include the Sale of Goods Act and the Consumer Protection Act. The CPA is wide-ranging consumer protection legislation covering everything from repairs, to door-to-door sales to unfair or unconscionable business practices.

So, when the Ontario Government proposes changes to the CPA, dealers need to be aware.

One right the CPA presently gives consumers who can prove they are victims of false, misleading or deceptive business practice is to fully cancel the contract within one year of the date of the agreement.

In a consultation paper released in this summer, the Government proposes changing this to one year from the time the consumer discovers they have been the victim of an unfair practice. This could extend the right of rescission (as it is known) far beyond one year from the date of the sale.

The UCDA has been in touch with the Ministry and made our concerns known. It’s still unclear at this point, if the proposals would be restricted to in-home sales, or be extended more generally into the marketplace … including to sales made by motor vehicle dealers.

Among other proposed amendments that may cause dealers further concerns are:

- expanding the mandate and authority of those charged with enforcing the Act (including OMVIC) to ensure they have the powers necessary to compel businesses to comply with the Act;

- requiring businesses to ensure that, upon cancellation by a consumer of a service contract that is subject to the Act, all related agreements consumers were subject to (such as financing arrangements or registered security interests relating to the primary contract) are also fully terminated; and

- amending the Act to allow for Administrative Monetary Penalties (AMPs), (basically fines imposed through receiving a “ticket”, rather than through the order of a judge) to be imposed on parties that contravene the provisions of the Act.

It remains to be seen whether any of these changes will actually be implemented and if they are, what if, any powers will be extended to organizations like OMVIC. The UCDA will monitor developments closely.

Social Media … Live by the Sword, Die by the Sword!

Businesses have come to rely, perhaps too much, on good reviews on Google, Yelp, and so on. Dealers are no different.

Have you ever taken the time to go on to other dealers’ sites and read the reviews that are posted there? It can be entertaining … even educational.

Of course, there are the suspicious looking ones that praise the business to the heavens, but appear never to have left another review about anyone, anywhere. There are the strange ones posted by angry people (what the internet world might call ‘trolls’), which tend to say more about the person posting them, than the business they’re attacking.

Then there are the legitimate posts that either praise a dealer or offer criticism. The best of them explain what their concern is and often, in those cases, you will see the dealer offer their side of the story and perhaps even a solution where appropriate.

We have, however, noticed a disturbing trend lately.

Apparently, some dealers have decided it is an appropriate use of their time to post negative comments on other dealers’ review sites!

As was noted earlier, since negative posts often say more about the party posting than about the business they are commenting on, we would urge dealers to avoid this at all costs.

In one instance we are aware of, a dealer posted a review on another dealer’s website that they felt this dealer was “fake”, that they “lied”, “falsified information” and are a “horrible business”.

Aside from the fact this can get the dealer leaving such a post sued for libel, as the dealer who received this review is considering, it is unseemly and must stop.

If the dealer who posted this review were a member of the UCDA, which thankfully they are not, they would be subject to expulsion from UCDA membership for a violation of our Code of Ethics, key components of which are:

- To promote and convey a positive image on behalf of all dealers and support efforts to improve the industry’s products and services; and

- To promote the benefits of industry products and services, without being unfairly critical of those offered by other dealers.

Social media is a powerful tool. It can provide an excellent forum for dialogue, but when misused it can be a dangerous sword that can cut both ways.

Certification Course Classes

We have 5 OMVIC certification classes currently scheduled through the end of October at the Wye Management Training Facility in Vaughan (unless otherwise noted).

The classes are taught by UCDA trainers.

| Monday, October 7 |

| Thursday, October 10 |

| Wednesday, October 16 |

| Tuesday, October 22 – Holiday Inn., Fairview Rd. Barrie |

| Tuesday, October 29 |

For more information and to register, please contact Michelle, at education@ucda.org or Val, at v.maclean@ucda.org .

Dealer Quiz

- The Consumer Protection Act provides protections for consumers of particular interest to dealers. Which of the following can affect dealers?

(a). in-house vehicle finance deals, where the customer has paid more than 2/3rds of the purchase price, the vehicle cannot be repossessed by the dealer in the event of default without a court’s permission

(b). there is a 10 day cooling off period allowing a consumer to back out of a purchase contract

(c). dealers who do repairs must post a sign explaining rates

(d). every lender shall deliver an initial disclosure statement for a credit agreement to the borrower

(e). (a), (c) and (d). - Another piece of legislation that can affect dealers is the Sale of Goods Act. Which, if any, of the following can found in this Act?

(a). human rights regulations

(b). bill of sale design requirements

(c). dealer or salesperson registration requirements

(d). implied warranty of fitness

(e). one year contract rescission rights - I have a vehicle out on lease. The vehicle remains in the dealership’s name, while the plates registered to the vehicle belong to the lessee. I don’t need a lien on the vehicle because this is a lease.

True or False? - The Motor Vehicle Dealers Act and Regulations require that a dealer declare if a vehicle was recovered after having been stolen.

True or False? - The Motor Vehicle Dealers Act contains provisions allowing authorized officers of OMVIC to pursue fines for offenses that have not been paid within 60 days and to take certain enforcement steps. Which of the following is NOT within OMVIC’s power.

(a). To arrest the person who owes the money

(b). To lien the personal property of the person who owes the money

(c). To lien the house of the person who owes the money

(d). To report the unpaid debt to a credit reporting agency

(e). All of the above

UCDA at Habitat for Humanity Automotive Industry Build Day

The weather couldn’t have been nicer on September 18, as UCDA Executive Director, Warren Barnard, armed with a hammer and tool belt, joined other volunteers from several automotive industry organizations to kick off the first-ever Canadian Automotive Industry Build for Habitat for Humanity Canada.

A t t e n d i n g the ceremony with the UCDA were team members from Cox A u t o m o t i v e C a n a d a , as well as partners from Canadian B l a c k B o o k , CARFAX Canada and Hyundai Canada.

Other sponsors included Desjardins, the Bank of Montreal, Scotiabank and TD Canada Trust.

Together, these sponsors presented a cheque for $100,000 to Habitat. The UCDA and Manheim Canada donated money raised at the 2018 and 2019 Ruth HartStephens and Bob Beattie Golf Tournaments.

The Canadian Automotive Industry Build allows the automotive industry to help build stronger communities by assisting families to achieve strength, stability and self-reliance. On average, Habitat generates $175,000 of benefits to society for every home built.

- In 2018, 238 families began building strength, stability and independence through affordable homeownership.

- Since 1985, 3,619 Canadian families have partnered with Habitat Canada to get access to a decent and affordable home.

- In 2018, Habitat’s affordable homeownership program generated almost $42 million in societal benefits to the community.

- In Canada, Habitat’s affordable homeownership program has added $68 million to the affordable housing portfolio in 2018 alone!

Habitat homes are sold at fair-market value, with an interest free mortgage, to selected families who may not be eligible for a conventional mortgage, and who are also expected to contribute up to 500 volunteer hours to Habitat.

Canadian Automotive Industry Build volunteers will be at the Mississauga build site, along with other volunteers and Habitat c o n s t r u c t i o n staff, through to the end of October. On October 4, six U C D A s t a f f members will join volunteers from Manheim C a n a d a t o continue the construction of the two homes on the site. The homes should be ready to be occupied sometime in 2020.

For more information about Habitat for Humanity, please visit: https://habitat.ca/

Quiz Answers

- The answer is (e). Only (b) is incorrect. There is no cooling off period on the purchase of a motor vehicle from a dealer.

- The answer is (d). All motor vehicles sold by dealers have a warranty of fitness for the purpose intended, implied by the Sale of Goods Act.

- The answer is False. In order to protect your interest in the vehicle against third party claims, customer bankruptcy, and for insurance purposes, you should ALWAYS register a lien when leasing a vehicle.

- The answer is True. This is one of the 21 required disclosures under the Motor Vehicle Dealers Act.

- The answer is (a). OMVIC officers cannot arrest a person for not paying a court ordered fine, but they can do the other things listed.