2019 RUTH HART-STEPHENS & BOB BEATTIE GOLF TOURNAMENT

The 4th Annual Ruth Hart-Stephens & Bob Beattie Golf Tournament was another huge success this year! We’d like to send a big thank you to our participating UCDA Members, Sponsors and UCDA staff who are always there bright and early to make sure registration runs smoothly. A very special thank you also goes out to Shannon Newman of Cox Automotive for her tremendous organizational skills and to the staff from Cox Automotive and Manheim who were there to assist her.

UCDA Member Service providers generously stepped up to sponsor our tournament, so much so that every sponsorship available was completely sold out! Desjardins was once again our Title Sponsor, NAPA was our power cart sponsor and donated their player spots as a Manheim Auction draw prize. Baird MacGregor Insurance Brokers were once again the sponsor of the Post Golf Reception, where drinks and hors d’oeuvres were enjoyed by all.

So, a big thank you to all of our new and returning sponsors – we couldn’t have done it without you:

The primary focus of this fundraiser is always the Bob Beattie and Ruth Hart-Stephens Scholarship Awards at the Automotive Business School of Canada. The successful applicants will receive their scholarships in September.

Anti-Spam Update

2019 has seen a number of Canadian dealers receive citations from the CRTC under Telemarketing Rules (Part 3, Section 3, https://tinyurl.com/y5d2lw6q) for breaches of the National “do not call registry” system. A citation identifies alleged violations and sets out the specific corrective action to be taken within a certain time frame. The names of individuals and organizations that receive citations are published on the CRTC’s website: https://tinyurl.com/y3se28wz

This should serve as a timely reminder about rules restricting how businesses may contact consumers to promote their products.

The CRTC also polices anti-spam communications, and it’s not just businesses that need to be concerned. It is also the officers and directors of the companies behind those communications.

In April, the first decision by the CRTC came down levelling a fine of $100,000 against an individual for off-side communications by a corporation he owned or controlled (the maximum fine is one million dollars).

The CRTC issued the fine, under the Canadian AntiSpam Legislation (CASL), against Brian Conley, the president and chief executive officer (CEO) of a group of businesses known as the “nCrowd” companies.

The business activities of these companies involved promoting the products and services of merchants on various websites, including by the sale of electronic vouchers for these products and services.

In this case, the companies sending the messages quickly dissolved or otherwise ended, so the CRTC decided that any enforcement actions directed towards these companies would have no deterrent effect. As a result, the CRTC pursued the corporate directors through vicarious liability in order to encourage future compliance with CASL.

The CRTC investigation lead to Decision 2019-111, which found that between September 25, 2014, and May 1, 2015, nCrowd, Inc. sent Commercial Electronic Messages (CEMs), or caused or permitted any of its subsidiaries to send CEMs, to electronic addresses without consent, and without a functioning unsubscribe mechanism, contrary to CASL. The CRTC found that Brian Conley acquiesced in these violations, while he was the president and CEO of the nCrowd companies.

A dealer-focused Preparedness Guide has been designed for more information on anti-spam laws:

This document is used with the kind permission of SCI MarketView, NortonRose and Canadian Auto Dealer. More information on all of this available from SCI at https://tinyurl.com/ya85zefd or call 888.919.8084.

The CRTC is tasked with enforcing CASL and also has a useful website with more information at https://tinyurl.com/obb5tr7.

Why Keep It Secret?

As our readers know, the number one reason consumers call us for mediation help is to request cancellation of their purchase. Unfortunately, customers often change their minds after signing the “sales final” bill of sale or lease agreement and then want help getting their deposit back from the dealer.

As members also know, UCDA bills of sale and leases are designed to address this with clauses and protections for both dealers and consumers contained within the contract.

For example on the front of all UCDA New and Used Vehicle Bills of Sale the words “SALES FINAL” are written. On the back, is Clause #4, ACCEPTANCE BY PURCHASER, a blueprint for how to proceed with deposits in these cases. On the UCDA lease, the Clause is #17.

More and more often, we are finding that customers who call us do not actually have a copy of their contract in their hands. Why? It seems some dealers will not provide a copy of the signed contract until the day of delivery which may not come for days or even weeks after it is signed. This is not a good practice and does not help the dealer.

When we try to help the customer read the various provisions that apply to their question, they have nothing to refer to and we have to suggest they call the dealer to get a copy of the front and back of their contract. Not only is this a nuisance, but it can also jeopardize the deal.

Without a contract dealers have no legal protection, so why wouldn’t a dealer want the customer to have that important bill of sale or lease from the moment the deal is struck?

There’s another good reason.

It’s the law! The Motor Vehicle Dealers Act requires that the purchaser or lessee be given a copy of the contract “immediately after signing it”.

Why risk having a customer or a court challenge the legality of a binding contract where you did everything right except the easy part – sliding a piece of paper across the table to the customer?

How Secure is Your DMS?

A story reported on by U.S. media, concerns a DMS (Dealer Management Service) provider out of Ohio who failed to properly protect consumer data stored by 130 or so dealers using their platform.

The result was a catastrophe in terms of a privacy breach, allowing upwards of 12.5 million consumers’ personal information to be accessed by hackers in 2016.

Needless to say the fallout for the company since has been severe, but what about the dealers … and their customers? Only time will tell where, when or if that data might land.

Meanwhile the DMS has settled issues with the Federal Trade Commission.

What safeguards does your DMS have in place? How secure is your DMS?

If you don’t know the answers to these questions … ask your DMS.

Misleading Advertising And The Competition Tribunal

Our readers may recall we previously reported on a Competition Tribunal case against the Hudson’s Bay Department Store (HBC).

It was alleged that HBC engaged in deceptive marketing by offering sleep sets at grossly inflated prices (prices so high no one ever, or hardly ever, will buy them at that price point) then drastically lowering the price to actually sell them at a more normal market price, while claiming huge resulting savings in their advertising to consumers.

It was also alleged that HBC falsely advertised “clearance” or “end of line” sleep sets, implying in the minds of the public that these are inventory priced to move while, during these periods, HBC continued to order new sleep sets to meet the demand.

As is not uncommon in such matters, the whole affair has been settled by way of a “consent agreement” in which HBC does not admit the allegations, but agrees to a series of corporate improvements and fines.

HBC will update its advertising practices and pay a fine of $4 million, plus $500,000 in costs, to the Competition

Bureau! This took over two years to resolve and you can only imagine the legal bills for both sides had to have been massive.

You can read the whole decision here: https://tinyurl.com/y47cgulf

The take away message for dealers?

Take these allegations and substitute cars or trucks for “sleep sets”.

If dealers did the things alleged here, they could face similar action by the Competition Bureau. When you think about it, you can see why it matters.

How could there ever be a level playing field between vendors or confidence in the public perception of any industry that engaged in false advertising such as was alleged in this case?

Indeed that is why OMVIC’s Standards of Business Practice, https://tinyurl.com/y6y4mrrz, which have been in place now for almost two decades, specifically contains sections to prevent:

1. Misleading price advertising; and

2. Language that falsely suggests inventory “must go”, “fire sale” pricing, “last chance” and that kind of thing … if untrue.

Some of this is common sense really, but it bears repeating, and keep in mind, it’s not just OMVIC that’s watching!

Appraisals – Clarification

In our last issue we mentioned that dealers are able to appraise used vehicles for tax value on private transactions.

The Ontario Government will accept a dealer’s appraisal of value to apply provincial sales tax at a licence office when private sellers and buyers are doing a deal.

As a point of clarification, and as the form itself makes clear, this service can only be performed by General (Retail) dealers, not, for example, Wholesale dealers.

Thank you to the alert readers who pointed this out to us.

An “Other” Identification Card

We have written many times about the “Certificate of Indian Status” card, issued by the Government of Canada, which is the only form of identification acceptable to exempt a Status Indian from taxes on a vehicle sale or lease. This is what the card looks like https://tinyurl.com/y3yjaj6f

Métis and other such Aboriginal ID, membership or association cards are not issued by the Government of Canada and do not exempt the holder from paying HST.

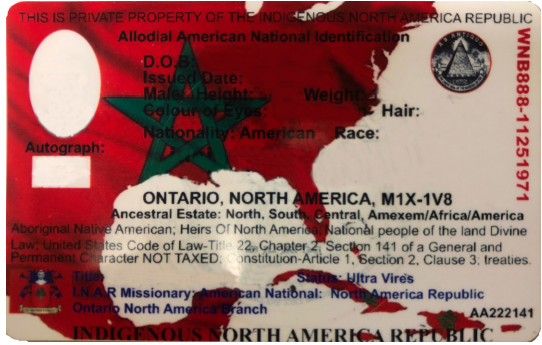

Recently, a new card has come to our attention. It is not being offered by a First Nations person, or a Métis, Inuit or other Indigenous person, but rather a card whose origins might be best described as quasi-religious in origin.

On at least two occasions, the holder of this card has tried to convince dealers that this card entitles them to a tax exemption on the purchase of a vehicle. It doesn’t, for the same reasons other cards that are not a Certificate of Status Indian Card issued by the Canadian Government do not qualify.

The card styles itself as “Allodial American National Identification” and as you can see, it is quite ornate, colourful and full of information, none of which has any relevance at all to the tax payable. We have removed the picture, name and address of the user of this card.

Be aware, if a dealer does not properly collect and remit HST on the sale of a motor vehicle, CRA may look to the dealer to recover it.

Repair / Tow Truck SCAM

When we discuss what we can write about for the next issue of Front Line, scams are fertile ground, because they come in endless varieties, are often fascinating in their silly complexity and they never, ever, go away.

Why is that? Sadly, because they work for the scammer. They work at least often enough to make it worthwhile for themselves, anyway.

We last wrote about the old repair / tow truck scam in 2013 and enough of our members have, or are, repair facilities that a recent email received by one of our members bears talking about.

The story goes like this …

A hearing disabled man from Manitoba needs his car fixed. He asks for a quote for a complete brake job and explains he has just moved to Ontario, but the vehicle is still in Manitoba (which is convenient because the dealer can’t run the VIN to see if it is even in this guy’s name). All of this by email, of course, due to his disability.

Anyway, he gets the quote and now things get interesting. You see, he is going in for surgery (for his hearing disability). He needs a huge favour, he has to pay by credit card (read fake or stolen). He plans to pay you $4,000. You are to take the $1,000 from that for your repair quote and send $3,000 by interac e-transfer (or cash, or wire transfer, it doesn’t matter really) to the tow truck company.

If you agree, he will helpfully provide all the contact details and the only real money in this whole fantasy will be what you send the “tow truck company”. You will, of course, never see the vehicle because there isn’t one and you will never, ever, see your money again.

The sad story used by the so-called “customer” can vary, but the idea is the same. He or she are in a tough spot and need a favour from you. Please, before you send thousands of dollars to people you don’t know … just don’t do it. If you’re in any doubt, call the UCDA for advice.