UCDA & DESROSIERS SURVEY MEMBERS ON COVID-19 IMPACT

In May and again in August, the UCDA, working with DesRosiers Automotive Consultants, surveyed Members about the effects of COVID-19 on their businesses. The earlier survey found that business had all but dried up for most Members during the April shutdown.

The most recent survey, conducted from August 4-11 and covering the months of May, June and July, received responses from close to 600 Members. It showed a much improved situation compared with the state of the industry in April.

While only 13.9% of responding Members were open for their regular hours in April, by July 48.3% were open regular hours. While this still left more than half the stores at less than regular hours, it was a huge step forward from the Spring. Complete closures of Member stores fell from 42.1% in April to just 5.0% in July.

Many Members have seen steadily improving sales in recent months. In July, as consumers released pent-up demand, nearly 40% of surveyed Members indicated sales volume growth compared to the previous year. However, 21.1% indicated a sales decrease of 1-25%, 23.4% indicated a decrease of 26-50%, and 15.9% indicated a decrease of 51-100%.

Comparatively in April, 99.1% of Members indicated that their sales volumes had dropped with the majority (54.8%) indicating a decrease of 76-100%.

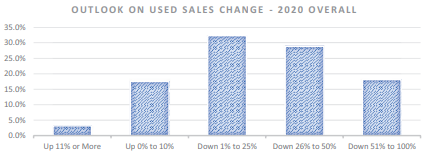

For the year overall, close to 80% of responding Members expect the market to be down from 2019, with the largest segment, 32.4%, expecting total sales to decrease between 1% and 25% in 2020.

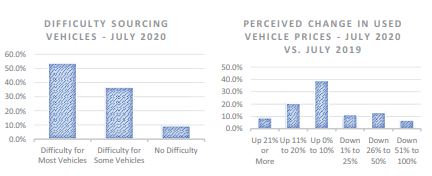

With regard to used vehicle prices, the majority of respondents (68.6%) saw price increases of varying degrees in July. A shortage of vehicles traded in during the Spring months has led to supply – demand mismatches in the market pushing prices higher.

This is also reflected in vehicle sourcing patterns for Members in July, with the great majority of respondents indicating challenges in sourcing some or all vehicles. Indeed, just 9.5% of respondents noted no difficulty whatsoever in sourcing vehicles.

From information received from Members since the survey was completed, August continued the trend from July. Sourcing inventory has continued to be a concern for most Members, despite a steadily increasing volume of vehicles going through the auctions.

Demand has remained steady, so prices have stayed high or have risen further on popular models. This has been exacerbated by the continued high demand at auctions from U.S. dealers, who are prepared to pay well over typical Canadian retail prices for used pick-ups and some SUVs.

OMVIC Renewal Form – Export Question

Not that long ago, OMVIC forms … applications, renewals, transfers … were all on paper. OMVIC has moved much of this online, as many dealers have with their own forms and contracts.

Generally, this makes life easier. However, it also creates its own unique challenges. For example, we rely, more than ever, on Members to tell us what they find confusing or difficult about some of the online forms they encounter from OMVIC. In many cases, we have not seen the form, because we do not have account access like dealers do.

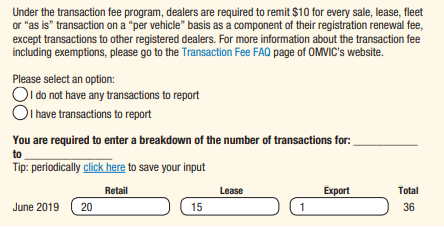

One form that dealers will encounter regularly is the “dealership renewal request” form. This is how dealers renew their dealer registration with OMVIC annually online. We recently learned that a new category had been added to the form for the transaction fee which asked about vehicles sold for “export”.

Many dealers export vehicles out of Canada, and in particular to the U.S., so this number, for some dealers, can be large. If the $10 fee applied to every such sale that number would be large too! What is important, and what the form may not have made as clear as it could have, is that the number you report for this purpose should not include sales to “dealers”.

This is how the form was worded:

We asked OMVIC to clarify that the form only expected numbers to be reported on sales to non-dealers, not the actual total number of sales to all buyers.

The other concern, in light of this possible confusion, is how dealers who may have “over-reported” could ask OMVIC to reassess the transaction fees they may have been charged in error.

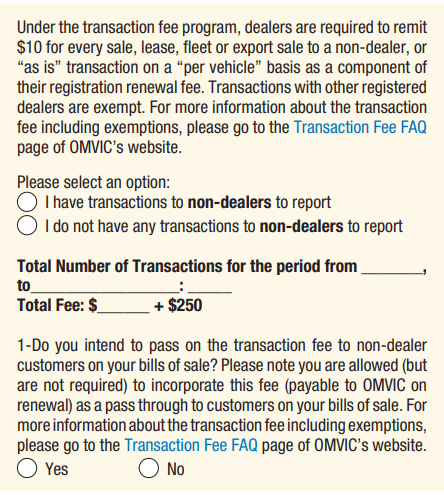

On the first issue, OMVIC has responded to the concern by amending the form to ask the question in a way that should cause less confusion. The new question emphasizes that the number of sales being asked for are sales to nondealers.

They have also updated their FAQ’s on the subject https://tinyurl.com/y6k6zytw

This is how the form is now worded:

As to the second issue, how do you correct reporting errors or seek adjustments to transaction fees charged in error? OMVIC advises dealers to contact OMVIC’s registration department, so OMVIC can get more information and check details. Your can reach OMVIC at:

registration@omvic.ca or call 1-800-943-6002 x3941.

Person In Charge

Uneasy lies the head that wears a crown.

– History of Henry IV, Part II, Act III, Scene 1

Every dealership has one. The man or woman on whose shoulders falls the responsibility for the day-to-day operations of the dealership.

In some dealerships, it’s easy to identify that person. If you are a sole proprietor for example, it’s probably you! In larger dealerships it becomes less and less obvious who that person might be or, more importantly, who that person should be.

Whether you are a business manager, sales manager, general manager or the “owner” of a dealership, it does not necessarily mean that you are the right person to be the “person in charge”.

This matters for two reasons:

- A “person in charge” is a term of art used in the Motor Vehicle Dealers Act. Under the Act, it is a condition of registration or renewal that each dealer appoints and identifies to OMVIC at least one “person in charge”.

- When dealers run afoul of the rules and regulations, and OMVIC takes the dealership to Discipline, they often levy fines and impose other requirements against the dealership (i.e. corporation) AND the person in charge.

So ask yourself, who is the “person in charge” at your dealership. This may not mean the same thing as who is the “owner” or “principal” of the operation. Who is the main manager, there all the time, watching and supervising dayto-day affairs?

The answer may surprise you and … it does matter … so be careful who you choose to designate for that role. It carries some potentially severe burdens with it.

If you are unsure who your person in charge is, contact OMVIC. You can also make changes on-line or by use of this form: https://tinyurl.com/yy2qt7on

Temporary Layoff Relief

We last reported on this issue in a Dealer Alert on June 1st.

The Ontario Government has extended the temporary layoff relief for employers, the effect of which is to help ensure a layoff does not automatically become a termination by the passage of time, as would normally be the case. This was set to expire on September 4, 2020.

Under the normal rules in the Employment Standards Act (ESA), a temporary layoff would have been deemed a termination after:

- 13 weeks, if no payments or benefits are continued;

- 35 weeks, if certain payments or benefits are continued; or

- for such longer period that an employee retains recall rights under any applicable collective agreement.

The Ontario Government has extended the amendment of a Regulation under the ESA to allow employers to place employees on Infectious Disease Emergency Leave. This will ensure businesses aren’t forced to terminate employees after their ESA temporary layoff periods have expired.

Workers will remain employed with legal protections and be eligible for federal emergency income support programs while employers will be protected from costly claims for severance or damages.

The extension will now last until at least January 2, 2021.

Dealer Quiz

- Under the Motor Vehicle Dealers Act Regulations, if the total cost to repair prior vehicle damage exceeds a set amount, the dealer must make a statement to that effect when the car is sold and if the actual cost to repair is known by the dealer that actual amount must be stated. What is the set dollar amount?

a) $1,000

b) $3,000

c) $750

d) none of the above - Dealer online advertisements must include:

a) the dealer’s registration number

b) the dealer’s name and business phone number

c) the word “Dealer”

d) b or c - A closed-end lease is a contract where the lessee (customer) is responsible for:

a) the vehicle’s residual value at lease end

b) mileage in excess of agreed kilometers

c) a and b

d) none of the above - Issuing a Safety Standards Certificate confirms that the transmission in a used vehicle has been inspected and will function properly.

a) True

b) False - The Consumer Protection Act provides consumers with an automatic “cooling off period” allowing them to change their minds and decide to cancel a vehicle purchase agreement signed at the dealership, without any consequences, within:

a) 24 hours

b) 48 hours

c) 10 days

d) none of the above

Consumer Protection Act, 2002 (CPA)

The CPA governs the way businesses relate to their customers, and describes illegal and unfair business practices known as “false, misleading or deceptive” representations and “unconscionable” consumer representations.

Consumers have up to one year to cancel a contract if they have been subjected to an “unfair practice”. This cancellation may be subject to reasonable compensation to the business.

Businesses are expected to disclose information that would be important to the customer in making the final purchase decision, whether or not the customer asks for the information.

So what are unfair practices? An extreme example would be selling a used car, but telling the buyer it’s a new car. Or telling a consumer a 4×4 was never used “off-road”, when in fact, it was used in the forests of Northern Ontario by the logging industry. It boils down to keeping important “material” facts about what you are selling from the buyer either by outright lies, exaggeration or half-truths.

There are other examples in the CPA of such misrepresentations, such as:

- describing benefits or qualities the goods do not possess

- suggestions that the supplier of the goods has sponsorship, approval, status, affiliation or connections the supplier does not have

- goods are of a standard, quality, grade, style or model that they are not

- saying the goods are available for a reason that does not exist or when the person making the representation knows or ought to know they will not be

- saying a price advantage exists, when it doesn’t

- misrepresenting the authority of the person dealing with the consumer to negotiate the final terms of the purchase

- making false or misleading representations that the proposed transaction carries with it certain rights, remedies or obligations

- misrepresenting the purpose or intent of any communication with a consumer

They all amount to the same message: “say what you mean and mean what you say”.

An “unfair practice” can also arise in cases where:

(a) a consumer can’t protect their interests because of disability, ignorance, illiteracy, etc.;

(b) the price grossly exceeds the price at which similar goods or services are readily available;

(c) the consumer is unable to receive a substantial benefit from the subject-matter of the representation;

(d) the consumer clearly can’t afford the deal;

(e) the consumer transaction is excessively one-sided in favour of someone other than the consumer;

(f) the terms of the transaction are so adverse to the consumer as to be unfair;

(g) a statement of opinion is misleading and the consumer is likely to rely on it to his or her detriment; or

(h) there is undue pressure.

For dealers, this means all information in contracts must be clear, comprehensible and prominent. If sales or lease contracts are missing required information, a consumer could cancel the transaction.

It also means dealers and their employees must be truthful … always!

Even ignorance about a vehicle’s defects or previous use may not be a defence. The CPA refers to things a business knows or ought to know. The CPA assumes that businesses have more resources and experience then consumers in determining the facts about what they sell.

For example, if a customer asks if a vehicle has been in an accident, and you know it has been, you must tell the customer. On the other hand, if you don’t know, don’t say “not to my knowledge”, but instead research and appraise the vehicle, as best you can, so you can answer the question with confidence.

Businesses and their employees found guilty of knowingly violating the CPA may also be liable to substantial fines and even imprisonment, in addition to the civil damages that could be obtained by the consumer in a lawsuit.

Answers

- The answer is b) $3,000.

- The answer is b) The dealer’s name and business phone number.

- The answer is d) none of the above. A closed-end lease is a rental agreement that puts no obligation on the lessee (the person making periodic lease payments) to purchase or guarantee the value of the leased asset at the end of the agreement.

- The answer is False. A safety inspection does not cover the transmission and most of a vehicle’s power train.

- The answer is d), none of the above. There is

generally no cooling off period on the sale of a vehicle

by a dealer.